Fortifying Trust: Exploring the Fraud Detection and Prevention Market

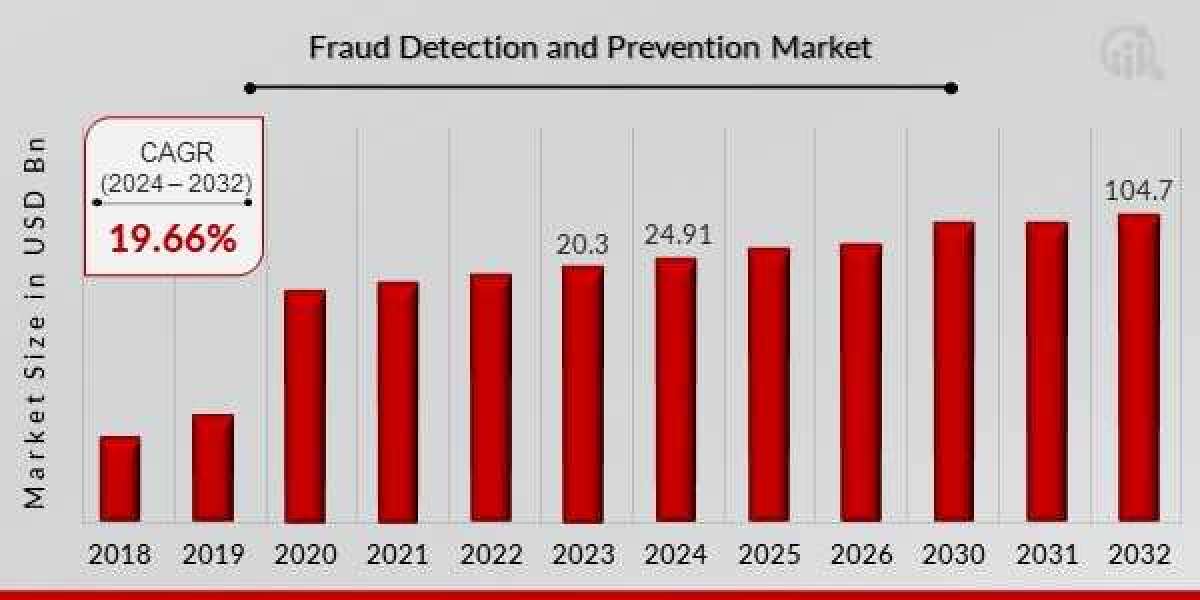

In today's interconnected digital landscape, the proliferation of online transactions and sensitive data exchange has fueled the need for robust fraud detection and prevention solutions. The fraud detection and prevention market, propelled by the escalating threat landscape and regulatory mandates, has witnessed significant growth globally. This article delves into the fraud detection and prevention market, providing insights into its market overview, key segments, latest industry news, prominent companies, drivers, and regional insights. The Fraud Detection and Prevention market size is projected to grow from USD 24.91 billion in 2024 to USD 104.7 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 19.66% during the forecast period (2024 - 2032)

Market Overview:

The fraud detection and prevention market has emerged as a critical component of cybersecurity strategies across industries. With the proliferation of digital transactions and the increasing sophistication of fraudulent activities, organizations are investing heavily in advanced fraud detection and prevention solutions to safeguard their assets and reputation. Market reports indicate a steady growth trajectory for the fraud detection and prevention market, driven by the escalating incidence of fraud, stringent regulatory requirements, and the adoption of digital technologies.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/2985

Key Market Segments:

The fraud detection and prevention market can be segmented based on solutions, services, deployment modes, organization size, and verticals. Solutions encompass a wide range of offerings, including identity verification, authentication, transaction monitoring, fraud analytics, and compliance management. Services include consulting, managed services, and training support. Deployment modes range from on-premises to cloud-based solutions, catering to the diverse needs and preferences of organizations. Verticals such as banking finance, retail, healthcare, government, and e-commerce demonstrate a growing demand for fraud detection and prevention solutions to mitigate risks and ensure compliance.

Industry Latest News:

Recent developments in the fraud detection and prevention market underscore its dynamic nature and the rapid pace of innovation. Key industry players have been unveiling new products, enhancing existing solutions, and forging strategic partnerships to stay ahead of emerging threats and market trends. Notable news includes the introduction of AI-powered fraud detection algorithms, partnerships between fintech firms and cybersecurity vendors to enhance fraud prevention capabilities, and acquisitions aimed at expanding product portfolios and market reach.

Key Companies:

Several prominent companies are at the forefront of the fraud detection and prevention market, leveraging their technological expertise and industry experience to address the evolving needs of organizations worldwide. Industry leaders such as IBM, SAS Institute, FICO, LexisNexis Risk Solutions, and Experian dominate the market landscape with their comprehensive portfolio of fraud detection and prevention solutions. These companies offer a diverse range of offerings tailored to meet the unique requirements of various industries and business models.

Market Drivers:

Several factors drive the growth of the fraud detection and prevention market, acting as catalysts for adoption and innovation. The escalating sophistication of cyber threats, including identity theft, payment fraud, and account takeover, underscores the critical importance of robust fraud detection and prevention measures. Regulatory mandates such as GDPR, PSD2, and PCI-DSS compel organizations to invest in compliance-driven solutions to protect sensitive customer data and mitigate regulatory risks. Moreover, the advent of emerging technologies such as artificial intelligence, machine learning, and blockchain presents new opportunities to enhance fraud detection accuracy and efficiency.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/2985

Regional Insights:

The fraud detection and prevention market exhibits significant regional variations, influenced by factors such as regulatory landscape, technological infrastructure, economic development, and industry verticals. North America leads the global market, driven by the presence of major players, stringent regulatory requirements, and high awareness about cybersecurity threats. Europe follows closely, with countries such as the UK, Germany, and France witnessing substantial investments in fraud detection and prevention solutions to combat financial crime and ensure regulatory compliance. Asia Pacific emerges as a lucrative market, fueled by rapid digitalization, increasing online transactions, and rising awareness about cybersecurity risks among enterprises and consumers.

In conclusion, the fraud detection and prevention market presents a dynamic landscape characterized by rapid technological advancements, evolving threat landscape, and stringent regulatory requirements. As organizations strive to safeguard their assets and reputation in the face of escalating cyber threats, the demand for advanced fraud detection and prevention solutions is expected to soar. With innovation driving the next wave of cybersecurity evolution, the fraud detection and prevention market is poised for sustained growth, offering immense opportunities for market players and driving the imperative to fortify trust in the digital economy.