For anyone considering precious metals, choosing to buy a bar of gold is a smart, strategic investment decision. Gold has maintained its value for centuries, serving as a reliable store of wealth and a hedge against inflation. For investors new to the gold market, buying a bar of gold provides a tangible, straightforward way to diversify their portfolio. This article covers everything you need to know about purchasing gold bars, from the types available to tips for making a wise investment.

Why Buy a Bar of Gold?

Investing in gold is a time-tested way to preserve wealth. Unlike other financial assets that can fluctuate wildly with economic conditions, gold tends to retain its value. Here’s why many choose to buy a bar of gold:

Long-Term Stability: Gold is often seen as a “safe haven” asset. Its value has remained stable over centuries and can provide protection during economic downturns.

Diversification: Gold behaves differently than stocks and bonds, making it an buy a bar of goldexcellent way to diversify a portfolio. It often rises in value when other assets fall, offering a buffer during turbulent markets.

Inflation Hedge: Gold has historically kept pace with inflation, helping investors preserve their purchasing power.

Physical Asset: Unlike digital investments or stocks, a gold bar is a physical asset. Many investors value the control and security that come from owning a tangible asset.

Types of Gold Bars Available

Gold bars come in various sizes and formats, each suited to different investor needs. Here are the main types:

Cast Gold Bars: Cast bars are created by pouring molten gold into molds, which gives them a rugged and unrefined appearance. These bars tend to have lower premiums over the spot price of gold because they are simpler to produce. They may not have intricate designs but are valued for their gold content.

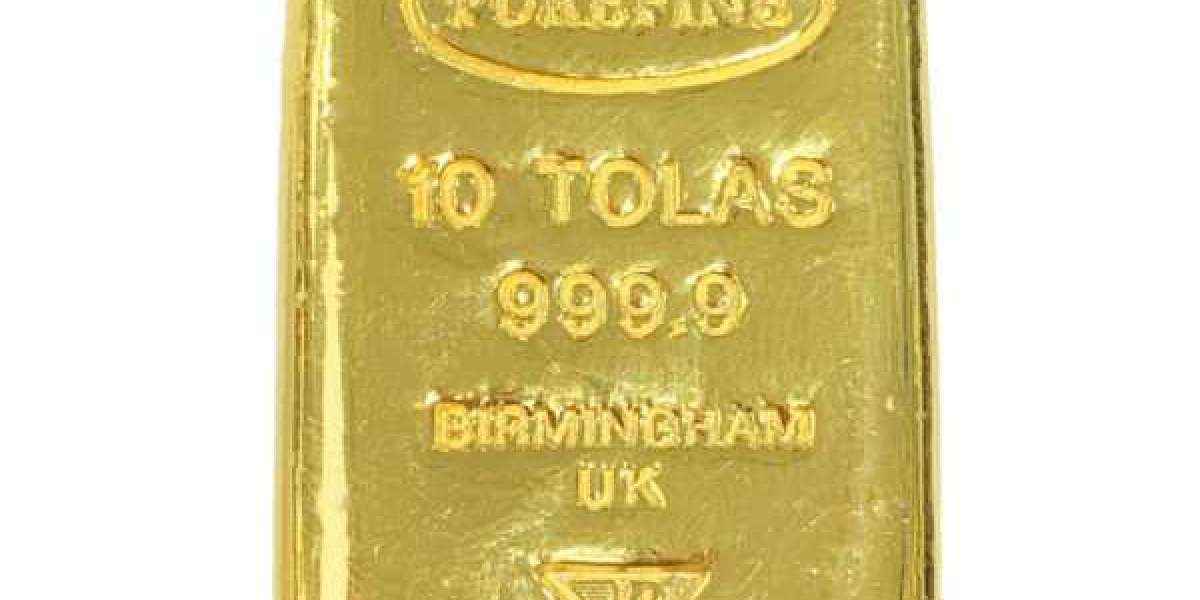

Minted Gold Bars: Minted bars are cut from refined gold sheets and typically polished to a smooth, shiny finish. They are usually engraved with the refiner’s logo, the bar’s weight, and purity, making them more visually appealing. Minted bars often come in tamper-proof packaging, adding to their collectibility and value.

Small Gold Bars (1 gram to 50 grams): These bars are affordable and highly liquid, making them ideal for new investors or those looking to buy gold incrementally. They’re easier to sell and store but usually come with higher premiums per gram than larger bars.

Medium Gold Bars (100 grams to 500 grams): These bars offer a balance between cost-efficiency and liquidity. They have lower premiums per gram than smaller bars, making them popular with serious investors.

Kilobars: Weighing 1 kilogram (about 32.15 ounces), kilobars are often preferred by high-net-worth investors because of their lower premiums per gram and significant gold content. They are efficient for large investments but can be less liquid due to their size and higher price.

Steps to Buy a Bar of Gold

Buying a gold bar involves a few important steps to ensure you’re getting quality and value for your investment:

Set a Budget: Determine how much you’re willing to invest. Gold bars range widely in price depending on their weight and the spot price of gold. Remember to factor in any additional costs, such as storage or shipping.

Choose a Bar Size: Decide on the size of the gold bar you want to buy. Smaller bars (1-50 grams) are easier to sell and more accessible for new investors, while larger bars (100 grams to 1 kilogram) offer better premiums.

Select a Reputable Dealer: Purchase from a reputable dealer to avoid counterfeits or scams. Look for established dealers with positive customer reviews, good industry standing, and secure online platforms.

Check Purity and Certification: Ensure that the gold bar has a purity of 99.99% (often referred to as 24-karat or .9999 fine gold). Certified bars from trusted refiners, such as PAMP Suisse, Valcambi, and the Royal Mint, come with an assay certificate and serial number verifying their authenticity.

Consider Storage Options: Gold bars require secure storage, either at home in a safe or in a bank vault or private storage facility. Many dealers also offer storage solutions for a fee, which may include insurance and added security.

Compare Premiums and Spot Price: The premium is the additional cost above the spot price of gold. Minted bars generally carry a higher premium due to their refined finish, while larger bars often have a lower premium per gram. Compare premiums from different dealers to get the best deal.

Tips for First-Time Buyers

If it’s your first time purchasing a gold bar, here are some helpful tips:

Start Small: If you’re new to gold investing, consider starting with a smaller bar. It’s easier to buy, store, and sell, providing flexibility as you get comfortable with the gold market.

Research Brands: Well-known brands like PAMP Suisse, Valcambi, Heraeus, and the Royal Mint are globally recognized and trusted. Buying from reputable brands ensures better quality and easier resale.

Avoid High-Pressure Sales Tactics: Stick to reputable dealers and avoid sellers using high-pressure tactics or offering “too good to be true” prices.

Understand the Market: Gold prices fluctuate, so monitor the spot price of gold to buy when it aligns with your budget and goals. Some investors use dollar-cost averaging, purchasing small amounts over buy a bar of gold time, to minimize the impact of price changes.

Insure Your Gold: If storing gold at home, consider purchasing insurance. Many home insurance policies can add a rider for valuables like gold, providing peace of mind.

Where to Buy a Bar of Gold

There are several reliable options for purchasing gold bars:

Authorized Bullion Dealers: Many bullion dealers offer a range of gold bars for sale, both online and in-store. These dealers often work directly with refineries, ensuring product authenticity.

Banks and Financial Institutions: Some banks, particularly in countries where gold is a common investment, offer gold bars for sale. While this option is secure, availability may be limited depending on your location.

Online Bullion Retailers: Many trusted online retailers specialize in precious metals, offering a variety of gold bars with secure shipping options. Be sure to check reviews and verify the seller’s credibility before making an online purchase.

Auctions: Gold bars are sometimes available at auctions, although this option is generally recommended for experienced buyers who can verify the authenticity and condition of the gold.

Conclusion: Is Buying a Bar of Gold a Good Investment?

Choosing to buy a bar of gold can be an excellent addition to your investment portfolio, providing stability, diversification, and a reliable hedge against economic uncertainties. With a variety of bar sizes and trusted refineries to choose from, gold bars offer a straightforward and tangible way to own a piece of one of the world’s most valued resources. Just be sure to research your options, select a reputable dealer, and store your gold securely to enjoy the lasting value that gold provides.