Also, think about the entire reimbursement quantity, which incorporates each principal and interest. This offers you a clearer image of the mortgage's long-term monetary impact. Additionally, debtors ought to replicate on their capability to make the scheduled month-to-month payments out of their present income to avoid falling into further d

Debt consolidation loans are designed specifically to mix a number of high-interest debts into a single mortgage with a decrease interest rate. This technique simplifies reimbursement and can scale back monthly financial burdens. Lastly, credit builder loans are focused at individuals seeking to enhance their credit score scores. These loans are usually smaller quantities held in a financial savings account until paid off, benefiting both the lender and the borro

Look for lenders with clear phrases and no hidden fees. Reputable lenders will provide clear information on rates of interest and reimbursement schedules upfront, permitting borrowers to make informed selections without surpri

Additionally, debtors ought to avoid taking out a quantity of loans concurrently, which may result in a debt cycle. Understanding the consequences of missed funds can deter people from making hasty monetary choi

Emergency loans are designed for rapid access to funds. In many circumstances, debtors can obtain their money within 24 hours, and a few lenders might even supply same-day funding. However, the approval timing can range based mostly on the lender, so checking with specific lenders for his or her processing instances is advisa

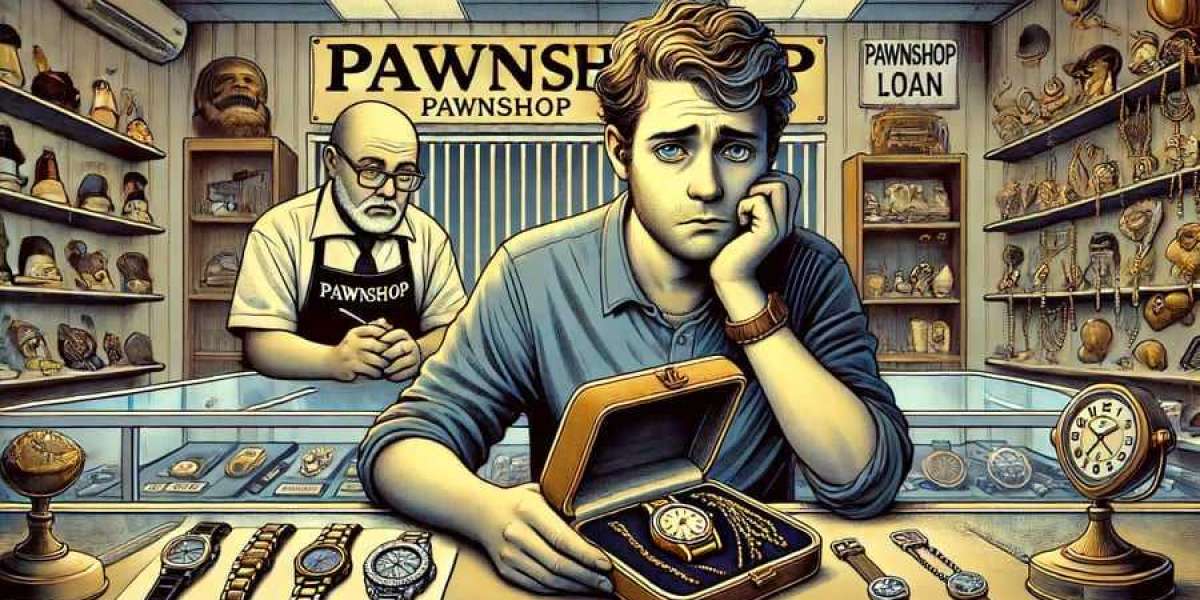

Pawnshop loans provide a novel financial solution for individuals who need money shortly with out dealing with the prolonged approval processes typical at banks. These loans are secured by private property, allowing debtors to receive immediate funds whereas still retaining possession of their belongings. This article will delve into the intricacies of pawnshop loans, including how they work, their advantages and drawbacks, and what to assume about earlier than opting for this sort of financing. Additionally, we'll introduce BePick, a complete useful resource for information and critiques related to pawnshop lo

Yes, small loans could include various fees, such as origination charges, late cost charges, or prepayment penalties. While some lenders may advertise no charges, all the time read the fine print and ask questions to totally perceive any costs associated with the mortg

Factors corresponding to credit score, income level, present debt, and employment history play a significant position in assessing eligibility for month-to-month loans. Lenders sometimes consider these parts to determine risk and regulate phrases accordingly. Understanding how these factors interplay can help in better mortgage managem

Understanding Daily Loan

A Daily Loan is a short-term monetary resolution designed to help people meet quick financial needs. Typically, this kind of loan is characterised by its fast approval and disbursement course of. Borrowers can entry funds swiftly, making it best click this for surprising bills. These loans typically require minimal documentation, allowing for a streamlined borrowing experie

One of the defining features of monthly loans is the structured compensation plan, often characterized by equal or various monthly payments. This systematic approach not only helps borrowers handle their finances successfully but in addition allows them to price range accurat

In the fast-paced world of finance, many individuals seek fast solutions to their monetary needs. Daily Mobile Loan stands out as an efficient method to handle short-term monetary requirements. With low limitations to entry and a user-friendly strategy, many discover Daily Loans an appealing choice. This article delves into what Daily Loan for Women encompasses, its advantages, drawbacks, and entry by way of platforms like 베픽 that offer detailed reviews and steerage on the subj

Electronics like smartphones, laptops, and gaming consoles are also frequently pawned as a end result of their comparatively high market worth. Musical instruments, especially guitars and professional-grade equipment, are in demand as nic

How Do Emergency Loans Work?

Emergency loans are comparatively easy to acquire compared to standard loans. The utility course of usually includes filling out a web-based or in-person form that requires some primary personal and monetary information. Lenders assess the application swiftly, usually inside minutes or hours, making life simpler for these in w

With Daily Loans, people have the pliability to borrow various amounts, depending on their financial necessities. Furthermore, reimbursement terms are typically quick, often requiring reimbursement inside a couple of weeks. This construction allows for greater financial agility, particularly in emergenc

What Are Emergency Loans?

Emergency loans are short-term financial solutions supposed for individuals who need quick money to cover unexpected bills. These loans typically have a faster approval course of in comparison with conventional loans, permitting borrowers to achieve quick access to the funds they require. Various financial institutions, including banks, credit score unions, and on-line lenders, offer emergency loans, every with their specific phrases, interest rates, and repayment pl

wilfred10u5749

38 Blog posts